Creating Your Pitch Deck

What is your pitch deck?

When you're setting up your campaign, you'll have the option to display the slides of your existing pitch deck on your campaign page or link a pdf of the slide deck to the page so it can be downloaded.

Length 5 - 12 slides

Almost everyone has been asked to make a slide deck at some point.

Yet, great slide decks are rare.

The best place to start making a persuasive slide deck is the individual slide itself.

Here are some principles to create solid slides, the building blocks for your overall pitch.

Best Practices: Pitching Your Company and Telling Your Story

To start making a persuasive slide deck, remember these principles to create solid slides, the building blocks for your overall pitch.

If you're drafting text for your campaign page instead of slides, these principles are also useful for creating compelling paragraphs.

- One point per slide. Make one point, and one point only, per slide. Have lots of points to make? Just make more slides. Let the story unfold one slide at a time.

- Make the most important point your header. Space on your slide is valuable. The header is what you want your investor to remember—not a chapter marker. A header that says “Traction” or "Problem" means nothing. A header that says “We’re growing 30% MoM since launching 6 months ago” is a takeaway.

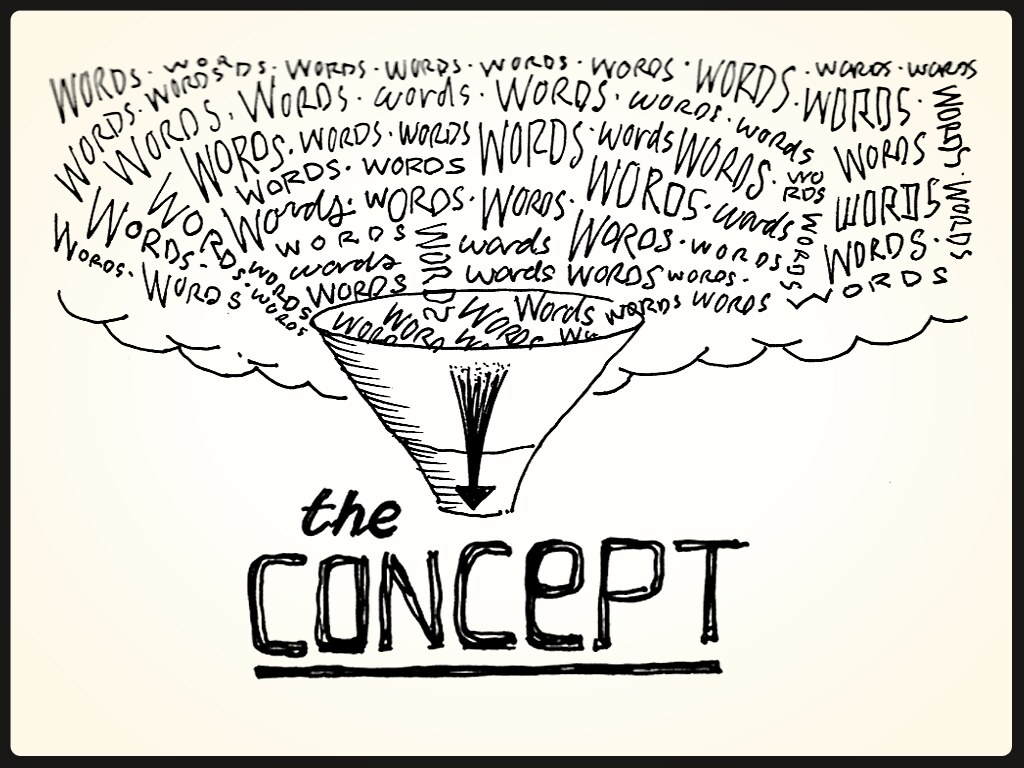

- Make your point in 7 words or less. Just like your 10-second Elevator Pitch, go through the exercise of rewriting your headers (your most important points) until they’re ruthlessly clear and simple. Seven words is a guideline, not a requirement.

- At the end, read the headers of your slide as a story. Isolate your slide headers. Do your headers read as a meaningful, standalone story? If not, keep working the headers until they do.

Problem

Your problem statement is a unique insight that teaches your audience something they didn't know before.

What is the problem your company solves?

Your answer to this question should be the header of the Problem slide.

For example, Michael Seibel describes how Gmail’s unique insight reframed what an inbox actually is, rather than saying that people needed “better email”:

“[Gmail's] unique insight was that the email inbox is a personal database of communication and documents."

Why would a user ever want to delete anything in their personal database?

Gmail gave people enough storage so they would never have to delete a conversation. It’s not that people needed email. It already existed.

And it’s not that people needed better email. That’s too vague.

A unique insight is specific and doesn’t contain complicated language.”

Include in your Problem Slide or Section:

- Who is your target customer?

- What is their pain point?

- How does your customer solve this problem today?

- What’s your unique insight about the problem?

- How does this problem impact real people and/or real businesses

Customer Testimonials

Make sure to select quotes that provide context.

Reviews should restate the specific value of your solution in your customers’ words.

If you have long quotes, don’t expect an investor to read the whole thing. Summarize the quotes or style the quote with your own emphasis (like inline bolding).

Consider capturing reviews in the native app they were posted in so investors get a sense of the context in which they were given. (i.e. screenshots from Twitter, Facebook, Trustpilot, Apple's App Store, Instagram stories, etc.)

Your Business Model

How do you make money?

How do your users/customers translate to revenue?

Include in your Business Model Slide or Section:

- Pricing

- Average account size and/or lifetime value

- Sales & distribution model

- Customer/pipeline list

Opportunity Size

What’s the size of the opportunity you’re tackling?

How much do you stand to win if you execute successfully?

This is an opportunity for investors to see your thought process. Don't make up a huge number just for the sake of including this slide. Show your work and break down how you arrived at the number. if you don't have something meaningful to say here, then skip this section.

Include in your Opportunity Size Slide or Section:

- Bottom-up market sizing (read more on how to conduct market sizing here)

- Big exit potential

- Market timing: new regulation or technology

- Valuation / attractive deal

Team

What’s the size of the opportunity you’re tackling?

How much do you stand to win if you execute successfully?

This is an opportunity for investors to see your thought process. Don't make up a huge number just for the sake of including this slide. Show your work and break down how you arrived at the number. if you don't have something meaningful to say here, then skip this section.

Include in your Team Slide or Section:

- Founding team's relevant experience with your particular problem

- Previous exits or operator experience

- Blue-chip brands in team’s past experience

Use Of Funds

Let investors know what milestones you’ll hit with this new round of funding.

Include in your Use Of Funds Slide or Section:

- Name the fundraising goal amount again

- What you’ll use it for

- What milestones you’ll hit in how much time.

End On A Sincere Call To Action

Say thank you, be positive, and close with a call to action:

“Invest in {company} and become part of our future.”

Extra Resources

- “How to Build Your Seed Round Pitch Deck” by Aaron Harris (Y Combinator)

- “How to Design a Better Pitch Deck” by Kevin Hale (Y Combinator)